[Editor’s note]

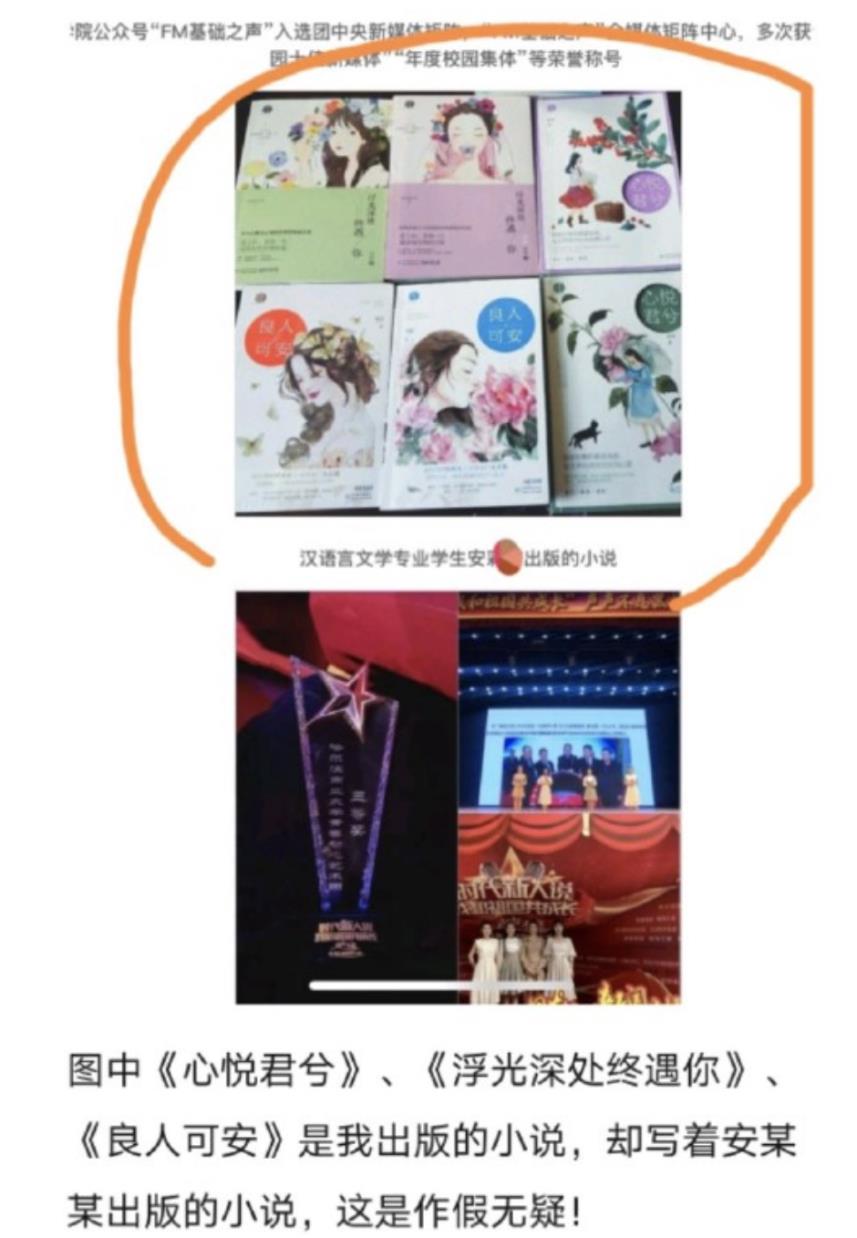

This paper selects the annual works in various categories that began to be serialized around 2021, with the popularity of word of mouth as the data reference.

"Reshaping the Millennium" Fishing Snow

Annual Entrepreneurial Business Warfare, Internet Direction and Feelings of Home and Country

Born a junior again, in order to make up for past regrets and save my cousin who will soon die because of lack of money, the protagonist fabricated his identity to act as a broker to bridge the gap between the leader and the boss, cheated the first bucket of gold by looking ahead, and then promoted the establishment of the hospital registration network, which is very similar to Dr. Ma’s early style of means to achieve his goal.

The protagonist is decisive, well versed in the way of the world, courteous, and skilled in networking with superiors. He can draw cakes for employees, tell venture capitalists about the future, be tactful, and talk to people/ghosts. The plot unfolds at a brisk pace, and the commercial map has gone global ~

Of course, the biggest controversy lies in the story of opening the cousin. After all, the story of promoting the registered network at the beginning of the Millennium is too advanced, which makes people feel a little taken for granted. However, judging from the story, the protagonist may not be unaware of the problem and has no intention of making money from the website at all. One is to set up a socially responsible entrepreneur, and the other is to find a gimmick to fool venture capitalists.

Recommended index, three stars to five stars, recommended to book lovers who like reborn entrepreneurial articles, the most worthwhile business war articles in 2021. Although there are some controversies in the opening of the registration network, the subsequent development is very exciting. The protagonist is quite homesick and has a large pattern, which reminds people of Zhang Ke ~ in the book "The Official Road to Rebirth". The reputation of this book can be called low opening and high walking, and the real fragrant party emerges, which continues to this day.

"kill BOSS successfully after entering the cyber game" eucalyptus cypress

Cyberpunk Jinjiang Female Frequency of the Year, Kexi Power.

The female host was selected to enter the Cthulhu Wind Cyberworld after taking part in the in-game internal test, and she crossed back and forth for seven days as a node. The setting is a bit like Nomenclature of the Night, in which all the earth players crossed the different worlds of Cyberpunk, and the two worlds repeatedly jumped and their bodies gradually converged, but there was a game property panel, which integrated various elements such as Cthulhu and urban power.

The protagonist belongs to the type of war determination and chaos neutrality. At the beginning, it is the undercover of Erwuzai sent by a rebel organization to the federal inspection department. Because he grew up in a small environment and quickly adapted to the cyber world with hard opening, he was not BB if he could start work, and the golden finger was the ability to kill the super-human. His writing logic was above average, and the plot was reasonable and not intellectually degraded, and his high IQ and rationality were convincingly interpreted.

The controversy lies in the fact that the protagonist’s aura is heavy, the supporting role is simple and rude (some of them are intellectually degraded), and he soon gets the golden finger of super perception and time back, and the combat power setting is unbalanced; The protagonist’s description is good, but the supporting role is average, without too much description and brilliance.

Generally speaking, the story of male frequency, the writing style of Jinjiang, is different from that of female frequency, with clean writing and excellent fighting scenes. At the same time, with the delicacy of female frequency, there are details and bedding, a realistic world of dark wind cyberspace is constructed, with compact plot, interlocking logic and self-consistency, which renders the tension of death games well. Although the setting is a bit old-fashioned, it does not hide the overall glory.

Recommendation index, three to five stars, recommended to book lovers who can accept female writers, like Cyberpunk, urban power, decisive war, and dark and cool style. This kind of hot and well-received work is still relatively rare, especially for women’s frequency books. I don’t know what children’s shoes to read. You can try it, and there may be surprises.

Iron and Steel Powder and the Caster Yin Zidian

Annual Western Fantasy, Slow-heating Indigenous Opening, Partial Entity Direction

The novel tells the story of an era when steel and gunpowder dance together, muskets are in the ascendant, armor is still the protagonist, military theories are changing with each passing day, innovations in system and technology are emerging one after another, and magic is powerful but mysterious. As a young officer, the indigenous protagonist explores the mystery of magic while adapting to the cruelty of war. The setting is very thoughtful, the magical world is analyzed with rational thinking, and the textual research is detailed and exquisite. The tactics and weapons in the early days of muskets are rigorous, and the description of war scenes is also recognized by many old book lovers.

The author has a profound accumulation of classical military knowledge, and has a solid understanding of the various backgrounds during the queue shooting period. His writing is precise and rigorous, with sufficient details, perfect logic, full of rationality and high authenticity. The core setting is full of explaining the magical principles, and the most important thing is the author’s creative attitude, which is very serious. Every major node will even draw their own pictures to explain it (battlefield map, continental map, etc.).

Looking at this book from the perspective of net text alone, there are actually many problems, such as the lack of sense of substitution caused by the indigenous protagonist, the group image at the beginning, the protagonist’s lack of sense of existence (improved after forty chapters), although the rhythm is compact, the main story is slow to advance, and the iron and steel powder is mainly used for the time being, with less magic and strong rationality, but compared with the mainstream net text, it is not cool enough. There’s still an unstable update in the past six months, and it’s become a weekly magazine …

The recommended index is three stars to five stars. Although this is not a mainstream upgrade, it is a rare drama to fantasy. The writing is fluent, the setting is rigorous, the author is very attentive and sincere, and it is a masterpiece worthy of giving some time and patience to taste. Especially suitable for military enthusiasts, textual research party, setting up party, science students, writing control, patient drama lovers.

"This game is too real" Morningstar LL

The fourth natural disaster of the year and the works with the highest word-of-mouth counterattack

The fourth kind of natural disaster, radiation wasteland, rebuilding homeland, is a farming article. The protagonist crosses the wasteland world after 200 years of nuclear war, becomes the administrator of the 404 refuge, and obtains the golden finger that can summon the players in the parallel world. So he pretends to be a game, fools acquaintances through QQ group, completes the game, and then expands the scale, tricking players to move bricks and pick up garbage for him step by step, and builds the doomsday refuge from scratch.

The fourth natural disaster text has been hot for two years. This book is the hottest one in this year’s fourth natural disaster text, and its reputation is also low and high. When it first came out, there was a lot of controversy. On the one hand, the introduction was a little boring, but the bigger controversy was: "Is the game interesting enough to attract players to participate?" At that time, almost all bad reviews were concentrated here.

Interestingly, as the plot unfolds gradually, the Zhenxiang Party keeps emerging, and the word-of-mouth counterattack has soared, which has almost become a phenomenal work in 2021. In the past month, hundreds of praises have been added. Although there are occasional bad reviews, the Zhenxiang Party has accounted for more than 90%, and a large number of messages have been left to find similar works.

The advantage of the novel lies in that, compared with the rough development of the same kind, the protagonist is more "meticulous", step by step in an orderly way, and the rationality is relatively good. The main line of the plot plays behind the scenes and takes a group photo. The focus is mainly on the infrastructure farming brought by senior intellectuals in the players, and the production is resumed in the last days with modern technology. The details are detailed and reasonable, and the style of writing is relaxed and funny, which dilutes the heavy feeling of the last days.

The recommendation index, from 3.5 stars to 4.5 stars, is recommended to book lovers who like the fourth natural disaster and the writing behind the scenes. This book is the work of the first echelon in the fourth natural disaster text, and its popularity is almost no less than that of the fourth natural disaster text "Conquering the Plane from the Game" in 2020.

Invasion of the World: clockwork orange’s Dream

The annual love story, the campus story with a little scary atmosphere, smells like "Hidden Kill"

At the beginning of the era of power, the ordinary high school students in small cities are involved in a campus violence and paranormal, solving the bad teenagers and saving the beautiful girls, and the heroine awakens the super power of summoning, but only the protagonist can see it.

As always, the writing style is excellent, the boys and girls are vividly portrayed, the youthful feelings between the male and female masters are well described, and the scary atmosphere is realistic. Both the characterization and the environmental description are very graphic, which is a bit like the feeling of being concealed and alienated before: "The delicate emotional collocation of campus teenagers seems to be surging into a new era of power, and it is getting better and better, which makes people look forward to it very much."

The controversial point is that the narrative rhythm of suspense and horror is a bit confusing for children’s shoes that they don’t like, followed by the fact that the protagonist’s positioning is temporarily assisted by wits, and he has no positive ability. Finally, the style of youth literature, in the words of book lovers, is: "a kind of taste of youth and early youth pain literature."

The recommendation index, four to five stars, is recommended to book lovers who like the style of youth love and literary works. Although this book is small in number, its reputation is unexpectedly good.

"Starting from the Red Crescent" Montenegro Old Ghost

The weird article of the end of the year, the amazing weird flow at the beginning, and the suspense direction of power

Mystery novel, an adventure about evolution and mutation, is set in the last wasteland after a strange outbreak. Humans are hiding in a safe area surrounded by high walls and struggling to survive. The protagonist thinks he is an ordinary person, but in fact he is a mentally ill person with fetters. His power comes from his invisible family: "sister", "mother" and "father".

The novel unfolds the story in the form of suspense and decryption unit drama, with wide brain opening, compact plot, harmonious world outlook and setting, humorous style, just right atmosphere rendering, first-class characterization, warm and harmonious family description, and the contrast between the protagonist and his family makes the protagonist’s characterization very profound.

Although there are many favorable comments, there are also some bad comments, such as the main line is still vague, the plot is too compact, and one event after another; The feeder pen and ink are too heavy, which seems to be a bit procrastinating; Pretending to be stiff and exploding in an orphanage is a bit cliche; Insufficient sense of promotion, the protagonist’s growth is not obvious; After the amazing beginning, the follow-up level has some ups and downs, and it is high and medium.

Recommendation index, three to five stars, recommend book lovers who like doomsday and suspense. This book is the double king of popularity and word of mouth in early 2021, and the popularity score of excellent books is also very high. It became an "annual adventure suspense work" at the annual reading meeting some time ago.

Listening to "The Manual of Surgeons"

The second element of the year, the ultimate sewing monster, and the customized text of the game.

The protagonist, a migrant worker in a mobile game company, started out dressed as a cult leader, but was wiped out by the local police station in less than a chapter … Then he woke up the Golden Finger secondary card-drawing game system and promoted his own upgrade by cultivating followers. As always, his aura was amazing at the beginning, his writing was smooth, and he was constantly humorous at the same time, which was very arresting.

The author’s brain hole and pen power are surprising, his style is unique, and his story is innovative. He discusses social ideas in the taste of the house and adds his own thoughts on the future social development in the description of the social structure of different worlds. The plot is fresh and interesting, and the leading and supporting roles are all set clearly. Outstanding sketch ability, beautiful interaction with my sister, and a few strokes can outline an impressive role; The setting is bright, the power system and the world background are very interesting, and the introduction of virtual exploration expands the thickness of the story.

It should be noted that the advantages and disadvantages of the book are very prominent, and the setting is complicated due to the extreme stitching. Moreover, because of the author’s writing history, novels are often bright in the early stage, but then they fall down in the later stage, and then the eunuchs become commonplace, and occasionally they are self-satisfied, and the plot is over-developed, which is very controversial. Book lovers who want to read this book must be psychologically prepared.

Recommended index, two to five stars, recommended to book lovers who don’t care too much about unfinished or eunuchs, like two-dimensional light novels, harem repair, and are curious.

Han Yousi, A Magic Professor at Hogwarts

HP Fellowship from the Perspective of Fellowship of the Year and Professor

Only by short videos can we understand the protagonist of some HP stories. Ten years before the start of the drama, a mixed-race Slytherin from Muggle Orphanage was born. With a lot of repeated practice, Goldfinger could improve the spell level, and he joined Hogwarts two years after graduation, becoming a professor of ancient magic, a young genius who was calm, rational and self-disciplined, pursued knowledge and strength, and had a professional ethics. His actual combat ability and theoretical research went hand in hand.

The protagonist is a standard Slytherin, a calm gentleman who is full of ambition and has his own rhythm. The plot begins three years after graduation (Harry’s second grade), and he goes back to school to apply for the third time as a professor of magic. He participates in the story in a way that he doesn’t fully understand the plot, so he doesn’t design the main line around the original plot and Voldemort. The original plot and the original plot are reasonable, the story is clear and fluent, and the reading sense is good.

The controversy lies in the background setting of the opening protagonist: crazy pursuit of power at school, duel with the pure blood family, and the escalation of the golden finger spell is a bit discouraged, but this part is only a passing, and the problem is not big, so bear with it.

Recommendation index, three to five stars, is recommended to book lovers who are interested in HP. If you are obsessed with the famous eunuch Professor Mo Wen at Hogwarts, this book is worth a try. Personally, I suggest reading the first 30 chapters, and if you still can’t read it, you should give it up.

"Actors don’t have holidays" closes crows.

The annual entertainment article "This star comes from the earth" author’s new book.

In his previous life, the protagonist was a double-flowered stick. His biggest hobby was watching movies, dressing as a graduate of a famous university in a parallel world, straying into the entertainment circle and embarking on the road of actors. The writing style and characterization are very good, relaxed and humorous, with a strong sense of acting plot, and I like the jokes caused by the conflict between the protagonist’s past life, habits and real life.

Compared with the previous work, it continues the setting of intermodulation in the development of Chinese and Western cultural industries (China is strong but Europe and America are weak), but the rhythm is better controlled, the literary flavor is weaker, the plot is more relaxed, and the characterization is more pleasing. The previous work is famous for its dog food, but this book is a vivid description of acting skills, which makes people feel immersive, and there is a breakthrough in drama selection. At the same time, it incorporates certain di elements and has a good interaction with supporting actors

At present, the biggest controversy lies in the collapse of updating, and I often take time off every day. In half a year, I have updated more than 200,000 words.

Generally speaking, this is an excellent and spiritual writer, but he tends to be a bit literary, so it is best for pure and cool literary party book lovers to be cautious.

The recommended index is three to five stars. There is also an anti-capital entertainment article, "This is not entertainment", which is also very worth pushing.

Tianrui Narrative of We Live in Nanjing

The annual science fiction article, the opening amazing doomsday rescue boutique

In 2019, the male host was a junior high school student who played short-wave communication. He once used his father’s ICOM725 short-wave radio station to call in an unmanned frequency band, but unexpectedly finished the call with the female host from the post-apocalyptic survivor in 2040. The story begins.

The novel describes the daily life of the male host in 2019 and the struggle of the female host in the end of 2040, which is both grand and delicate, and takes the real city of Nanjing as the place where the story begins, which strengthens the rationality and sense of substitution. No matter the style of writing or the creation of atmosphere, it is very tasty. Living alone and tenaciously in the last Pinellia ternata should be the most vivid character in Tianrui’s works so far.

Generally speaking, this is a good article about radio communication across time and space to save the world. It is ingenious in conception, amazing in story, hard-core in knowledge and full of imaginative romance. The double-line contrast between the male reality line and the female doomsday line is very novel, with the flavor of the last decade and the sci-fi elements. It is said that there is a feeling of watching the Gate of Destiny Stone.

It should be noted that the update speed of the novel is desperate, and it has updated 200,000 words in three months. At present, it feels that the ending may be a tragedy, so I don’t like it.

Recommendation index, three to five stars, recommended to book lovers who like science fiction, have patience in reading, and are not afraid of slow updating and tragic ending. With this book, the author won the Best Network Science Fiction Award in the 32nd China Science Fiction Galaxy Award. This is the second time that the author has won the Silver River Award for Best Network Science Fiction for "Death on Mars". In 2021, the sci-fi literature is not bad as a whole. In addition to this book, you can also try the sci-fi satire dystopia’s "Solar System: Alienation" and the group sci-fi brain hole "Disorderly wearing is a disease".

[Specially published by Shanghai Literature and Art Review Special Fund]