Consumption has become the main driving force of China’s economic growth, and there is still room for further exploration in all fields and links of consumption.

This article is a record of Yang Sulan’s speech at the "2024 China Catering Industry Summit", which was compiled and published by Red Dining Network.

This year is the twentieth year that I have been engaged in capital business. In 2004, after I graduated from Peking University, I went to Hong Kong and started working in the capital market. In the past twenty years, I have witnessed the development and changes of China’s economy and capital market, and I am also glad to have the opportunity to participate in many domestic and overseas listing, financing and M&A projects of China’s head enterprises, and have served many well-known enterprises, such as Nongfu Spring, Anta, Helens, Pot Circle, Zhenjiu Lidu, Shunfeng, Jitu and so on.

In the past twenty years, China’s economy has taken off rapidly, and great changes have taken place in the consumer industry. Especially in the past decade, with the progress of science and technology in the fields of Internet, AI, media and logistics, it has greatly promoted the rapid development and transformation of the consumer industry. There have been many changes in trading methods, trading places, logistics and transportation, digital application and so on.

01. In the past decade, the consumer industry has witnessed rapid development and change.

In terms of payment methods, the development of smart phones and communication technologies has prompted great changes in payment methods. China society has basically changed from cash payment to mobile payment, and electronic payment has become the mainstream. Payment is more convenient, which is a very big change.

In terms of trading places, many of them used to go to supermarkets and shopping malls, but now most of them have been transformed into online consumption. Such changes have also prompted the whole transaction to change in terms of people, goods and fields. The traditional consumption pattern used to be "goods → field → people" or "field → goods → people", but now the new consumption pattern has become "people → goods → field" and the core has become "people". The development of science and technology shortens the distance between people and goods, making it easier for goods to reach consumers.

In terms of logistics and transportation, the development and upgrading of logistics technology has provided important infrastructure for changes in consumption, transactions and other aspects. In the past ten years, there have been many express delivery companies in China, including SF Express and Polar Rabbit. They have made great contributions to the development of Internet transactions. Without the emergence of these efficient and low-cost logistics, e-commerce and online transactions would not have developed to this extent today.

Here is also an interesting phenomenon. In Europe, America, Japan and other countries with advanced technology, their online transactions or online purchases are not as popular as those in China. Why? I think there are two reasons behind this: First, the logistics cost of these countries, or the labor cost, is very high, and it is difficult for them to do logistics at a very low cost. Under the background of big environment, their online transaction costs will be very high, so they will not develop as fast as China’s logistics, which is the cost reason. On the other hand, people in these countries have higher requirements for digital privacy.

The development of science and technology has also greatly changed the operation of enterprises, especially the digital application. Using digital system, restaurants can achieve more refined management in personnel management, checking store revenue, product marketing and other aspects. It is also based on the application of digitalization that has spawned more chain catering brands.

In terms of products and packaging, the development of science and technology has also brought many changes, such as the appearance of self-heating hot pot and prefabricated products. The packaging of many products is becoming more and more beautiful now.

In the past decade, the proportion of consumption in GDP has been rising, and consumption has gradually become the main driving force for China’s economic growth. Especially last year, the contribution rate of consumption to the overall economic growth has reached 82.5%. This year’s two sessions also made clear arrangements for promoting the steady growth of consumption, and encouraging policies in various consumer-related fields such as cross-border e-commerce, tax exemption for outlying islands, new energy vehicles, and cultural tourism were introduced one after another.

02. With the disappearance of demographic dividend and intensified competition, the consumer industry is facing new challenges.

The progress of science and technology has promoted the continuous growth of the consumption field, and various sub-sectors of consumption have now blossomed. For example, there are many excellent enterprises in the catering field, such as: Haidilao, Honey Snow Ice City, Cookware Food Exchange, and tasteless food.

Will technology continue to promote the development of the consumer industry in the next decade? What are the development opportunities in the consumption field? Before answering these questions, it is necessary to look at the challenges that China’s consumer industry is facing after the rapid growth in the past decade.

From a macro perspective, the birth rate is declining, the population structure of China is gradually aging, and the growth rate of the total retail sales of consumer goods in the whole society is also slowing down, which is what we usually call "the demographic dividend is disappearing".

At the micro level, on the supply side, the competition among enterprises has become increasingly fierce, which is what everyone calls "becoming a special volume". For example, in the coffee track, many new coffee brands have emerged in the past two years; There is also tea. There is basically no shortage of tea shops in various cities, and some tea brands are also sprinting to the market. The fierce competition has brought more and more severe tests to the supply side. Only by doing a good job can enterprises survive and develop.

On the demand side, after 10 years of development, consumers’ tastes have become higher and their requirements have become higher. In the future, everyone’s requirements for products will only become higher and higher, and consumers’ consumption preferences and behaviors are also rapidly changing and adjusting.

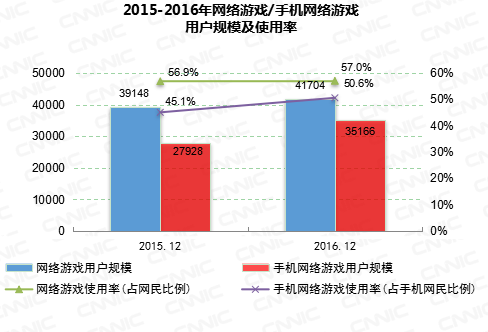

In the analysis of consumer behavior portraits, after investigation and statistics by professional institutions, it is found that consumers’ choices have become more rational now. Surveys conducted by Deloitte and McKinsey also show that consumers now prefer products that they really need and are cost-effective.

When choosing a specific product, consumers will first consider the quality and function of the product, then the price, and then the emotional value and brand.

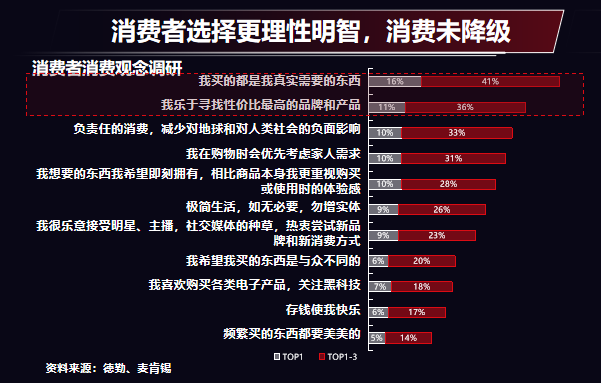

From the perspective of channels, consumers receive more and more information, and the channels for receiving information are becoming more and more diversified. There are more than 10 common channels for obtaining information, including e-commerce, shopping malls, live broadcasts and so on. This also means that there are more and more marketing channels for brands, because it is difficult to gain public recognition and recognition by marketing only through one channel.

In addition, consumers’ preference for domestic brands is also increasing. Back to ten years ago, or earlier, China consumers had a high degree of favor for overseas brands, and they thought that the quality of "foreign goods" was good. But in the last decade, especially in the last five years, domestic brands are slowly rising and winning the favor of more and more consumers.

To give a few typical examples, such as baby milk powder, we made a statistic and compared the milk powder market in 2013 and 2021. We will find that overseas milk powder accounted for more than 50% in the whole China market in 2013, but by 2021, the market share of domestic milk powder brands exceeded 50%, surpassing foreign brands; The use of mobile phones is also obvious. In the past, everyone liked to use overseas brands such as Nokia and Apple, but now the market share of mobile phones in China has exceeded 60%. There is also the field of fast food. The rise of local brands in China in recent years is very obvious, and the proportion of local fast food brands in the whole market is also increasing.

Finally, look at the capital level, the amount of social financing is also decreasing. In the communication with entrepreneurs, everyone generally said that private equity financing is getting harder and harder, and it is getting harder and harder to get money at the capital level.

All these have brought new challenges to the consumer industry in China.

03. In the next decade, three major trends in the consumer industry deserve attention.

Despite the challenges, technology will continue to affect consumption in the next decade. There are still opportunities in all fields and links of consumption. Mainly in three aspects:

1, intelligent

Intelligentization is a major direction for the development of the whole society in the future. Intelligentization can reduce costs, improve efficiency, improve cost performance and improve product functions, which are exactly what consumers need. As a consumer goods enterprise, if it wants to achieve good development, it must be recognized by consumers, and it is necessary to make more efforts in intelligence.

Specifically, intelligence will occur in many fields, including production, retail, catering, warehousing and so on.

For example, in the production field, the production of products will be further automated. For an enterprise like Nongfu Spring, there are few workers in its workshop, and it will adopt automatic packaging and intelligent production, and many production links are realized by machines.

In the field of catering, scanning code to order food is very common, which is also an intelligent performance. In the future, there may be automatic food delivery machines, vending machines and automatic checkout machines. There will be automatic brewing machines, milk tea machines and so on in the drink shop.

In the field of warehousing, autonomous driving may be more used in transportation in the future, and warehouses can also be made fully intelligent, and intelligent management can be implemented for the storage and transportation of goods.

In the field of smart home appliances, although the current development of real estate has encountered some problems, there is still a demand for personalized and convenient home experience, so there is still room for development in the smart home market.

2. Nationalization

As mentioned earlier, domestic brands are winning the market, the quality of local brands is recognized, and the proportion of domestic products is also increasing, but I think this proportion is not high enough and can be higher in the future. Taking food and beverage as an example, Coca-Cola and Pepsi occupy a large market share, while the share of domestic brands is still low, so there is still much room for exploration in the future.

The consumer market has changed from an incremental market to a stock market, and may even be a reduction market. In today’s market economy environment, there are still many opportunities in the consumer industry, but this is a structural opportunity. For example, the rearrangement between domestic products and overseas brands will bring structural opportunities.

With the development of social economy, the enhancement of China’s national strength and the progress of science and technology, the operating costs of enterprises will drop, the quality of products will be higher, and consumers will naturally prefer domestic products. China is a unified big market with a population of more than 1.4 billion. The market is large enough, and the adjustment of the ratio of "domestic goods" to "foreign goods" will bring many new development opportunities.

3. Innovation

This year, the two sessions once again emphasized a word called "new quality productivity". What is "new quality productivity"? It is the quality of advanced productive forces dominated by "innovation". To put it popularly, it is necessary to use new things, do some new creations and realize new development.

"New quality productivity" will be a major development direction in the future. Taking catering as an example, we can use some new tools to achieve innovation and intelligence, whether in the front room or the back kitchen or in other business links, so as to meet the changing needs of consumers.

Therefore, if consumer enterprises can dig deep in the three directions of intelligence, localization and innovation, they can find some new development opportunities.

Finally, you may also be concerned about how catering enterprises can win the favor of investors under the current new situation. In my opinion, current investors will prefer enterprises with the following three characteristics:

First, differentiated enterprises. Such enterprises can often find their own core positioning, clearly understand what kind of products they want to make, and distinguish them from other enterprises, with their own characteristics and differentiation, and do not follow the trend.

Second, enterprises that can achieve profitability. Whether it can generate profits is an important criterion for investors to judge whether an enterprise is good or not. If an enterprise has a high profit rate, it shows that the enterprise has good profitability and will naturally attract the attention of the capital side.

Third, enterprises with scale potential. Investors like leading enterprises in the industry, and leading enterprises often get good valuations. Therefore, if an enterprise has set a detailed and implementable large-scale development path at the beginning of its establishment and has the potential to become an industry leader, then in the view of the capital side, such an enterprise is also very promising.

(Note: This article belongs to the catering industry information published by Yangguang. com. The content of this article does not represent the views of this website, and it is for reference only. )