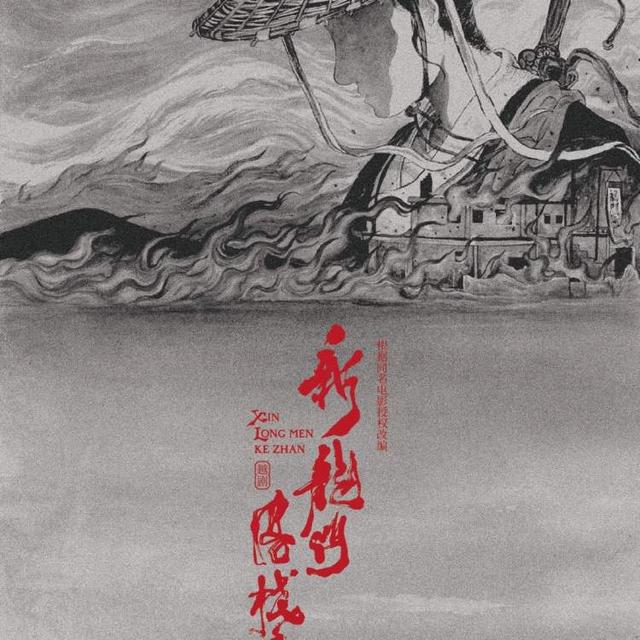

The film "Fortress" was premiered in Beijing on March 20th. Director Han Keyi, actors Guo Xiaodong, Chen Douling, Jinggangshan, Lv Xin, Yang Bo, Feng Hao and Liao Mengyan made their debut together, attended the red carpet ceremony and chatted with the audience after the screening. The atmosphere was warm. On the same day, the film exposed the "incoming" version of the poster, and for the first time fully disclosed the shape of the entire lineup, which made the audience’s expectations more and more high. The film will be released nationwide on March 22, and the pre-sale has been fully opened!

The main creation gathered at the scene to see the sincere belief and profound interpretation, which won numerous praises from the audience.

The film "Fortress" is adapted from real history, and takes five party member-Mao Fuxuan, Mao Xinmei, Li Genghou, Zhong Zhishen and Pang Shukan, who are known as "the five outstanding figures in Shaoshan", as the archetypes, and skillfully integrates the elements of spy war and suspense into the historical background, showing the heroic story of revolutionary volunteers fighting with enemy agents in the hidden front.

The theme of the premiere was "Please Break the Bureau", and relevant leaders such as Huaxia Film Distribution Co., Ltd., Publicity Department of the Communist Party of China Film Satellite Channel, Xiangtan Municipal Committee, Propaganda Department of Xiangtan Municipal Committee and Xiaoxiang Film Group were specially invited to attend. At the event site, the main creator unveiled the story behind the scenes and ignited the enthusiasm of fans. When talking about how to create this film, the director said that "Fortress" has a prototype story, and the team has read a lot of materials and done a lot of homework. Every character in the film is worth exploring. I hope this film can make everyone deeply understand this history and learn the power of faith from the game between the enemy and me. Guo Xiaodong, who plays the role of Shen Zhuoyi, said that this role is very challenging, which is very different from his previous roles. He dedicated his first experience as a villain to Fortress, explaining that the role is like a dark star dancing alone. Chen Douling also lamented the role of Hong Zheng, saying that Hong Zheng showed many feminine qualities. Although she was afraid but not timid in the face of enemy agents, she could grow in adversity like chamomile. Jinggangshan shares the role of Yang Jingchen by sincerely treating Mao Jiaxuan as a brother. Although he often plays the villain, this role is actually very hierarchical. In addition, actors Chen Minghao and Li Yitong and singer Chen Chusheng, the singer of the ending song "Waiting for Dawn", regretfully missed the premiere, specially recorded VCRs to send blessings, and more friends from the circle such as actors Cheng Lisha, Che Yong li, Meng Tingyi, Wang Yanan, Huan Wang, Aisha and Yang Ziyi were present to help out.

In the work Fortress, the wonderful collision between characters has undoubtedly become a highlight of the film, bringing countless unforgettable scenes to the audience. Fans have also expressed their love for movies, among which "the plot is tight and gripping", "the confrontation between good and evil is full of energy", "the role is full and three-dimensional" and "the emotion is sincere and makes people cry" are frequently mentioned. The audience were all attracted by the storyline in the film, and were deeply touched by the characters’ unswerving faith and fearless spirit.

The uncle circle’s drag show makes the audience hooked, and the survival rule of spy war makes people laugh.

The ups and downs of the film’s development trend made the audience scream, and the excellent acting skills of all the staff directly hit the audience’s heart, especially with the dramas of powerful actors such as Chen Minghao, Guo Xiaodong and Jinggangshan, which made the audience smile in a tense viewing atmosphere. The film focuses on investigating the secret identity "Pang Defu". In order to find out the truth, Shen Zhuoyi suddenly parachuted into the police station. In order to save himself, Mao Jiaxuan spared no effort to please the leader Yang Jingchen. The film profoundly reveals the survival law of the spy war workplace, and at the same time reflects the interpersonal relationship in the contemporary workplace. The audience sighed and saw the true portrayal of the workplace, and even expressed their admiration for the acting skills of the uncle circle actors in the post-screening session. The status of the role is far ahead, which is very emotional.

The film "Fortress" is excellent in character shaping and plot design, which makes the audience feel the complexity and profundity of human nature and highlights the dedication and greatness of revolutionaries. Mao Jiaxuan, played by Chen Minghao, has a sleek and sophisticated surface, but sticks to his faith in his heart, always facing the heavy pressure and danger from hostile forces. Shen Zhuoyi, played by Guo Xiaodong, is a typical elite in the workplace, smart and resourceful, and good at using all resources to achieve his goals. Yang Jingchen, played by Jinggangshan, is arrogant to his subordinates, but obedient to oversight, which fully shows the tactics and tricks. The intricate relationship and conflict between them have injected rich drama into the film, which makes the audience’s emotions fluctuate and always look forward to the next development.

Who will be reborn in the spy city fight? All the staff will stage a reversal drama and the suspense will be upgraded.

Today, the movie "Fortress" released an "incoming" poster, and all the staff gathered coldly under the stormy spy city, adding tension to the contradictions and conflicts, and a tense momentum filled the air. Although it was a silent confrontation, the real reaction of each character in a life-and-death crisis was revealed, which made people hold their breath.

Chen Minghao’s eyes are firm, but it is unpredictable; Guo Xiaodong’s face is unfathomable, and it makes people nervous in silence; Li Yitong’s eyebrows slightly wrinkled, full of complicated worries; Chen Douling’s eyes are bold, showing a fearless; Jinggangshan’s expression is meaningful and vaguely murderous. In addition, Song Ningfeng, An ‘an, Bai En, Zhang Aoyue, Yang Bo, Yi Heng and other leading actors all appeared, and the boundaries between the forces of all parties became blurred, and the distinction between good and evil became more and more confusing. Who can survive in this life-and-death contest? Let’s wait and see on March 22nd.

The film "Fortress" was produced by Xiaoxiang Film Group Co., Ltd., Tianjin Cat’s Eye Microfilm Culture Media Co., Ltd., Xiangtan Daily, Xiangtan Zhaoshan Cultural Industry Development Co., Ltd., Xiangtan Urban and Rural Construction Development Group Co., Ltd., Xiangtan Radio and Television Station, Shaoshan High-tech Construction Investment Co., Ltd., and jointly produced by Hunan Xiaoxiang Youth Film Co., Ltd. and Hunan Manhao Film Co., Ltd. In the hot pre-sale of the film, I look forward to meeting the audience on the screen!

?