The Central Committee of the Communist Party of China recently issued the "Regulations on the Selection and Appointment of Leading Cadres of the Party and Government", stipulating that officials whose spouses have moved abroad should not be promoted. The media pointed out that this is the first time that the "Regulations on the Appointment of Cadres" has been added to prohibit the promotion of "naked officials". This revision is the first revision of the "Regulations on the Appointment of Cadres" in the past 12 years, and it has also added contents with high social concern such as "the cadres who are accountable shall not be promoted within two years" and "those who are not well recognized by the masses shall not be listed as the object of investigation".

Zhao Leji, Director of the Central Organization Department (data map)

The Regulations on the Appointment of Cadres has been greatly revised.

Recently, the Central Committee of the Communist Party of China issued the "Regulations on the Selection and Appointment of Leading Cadres of the Party and Government" (hereinafter referred to as the "Regulations on the Appointment of Cadres"), and issued a notice, requiring all localities and departments to conscientiously comply with the actual situation.

The circular pointed out that the "Regulations on the Appointment of Cadres" promulgated by the Central Committee in 2002 played a very important role in standardizing the selection and appointment of cadres, establishing and improving a scientific selection and appointment mechanism, and preventing and correcting unhealthy practices in selecting and employing people. However, with the changes in the work situation and tasks of cadres and the status of cadres, the Regulations on the Appointment of Cadres can no longer fully meet the new requirements, and the central government has decided to revise it.

The revised "Regulations on the Appointment of Cadres" embodies the new spirit and new requirements of the central authorities for the work of cadres, absorbs the new experience and new achievements of the reform of the cadre personnel system, and improves and perfects the cadre selection and appointment system according to the new situation and new tasks, which is the basic follow-up for the selection and appointment of party and government leading cadres and a powerful weapon to prevent and control the unhealthy trend of selecting and employing people from the source.

Why do you want to make such a revision after 12 years? Xie Chuntao, President and Editor-in-Chief of the Newspapers and Periodicals Society of the Central Party School, believes that according to the experience and lessons of the selection and appointment of cadres in recent years, the regulations on the selection and appointment of cadres have been greatly revised this time, especially for the issues that have been discussed by the public, and they have been perfected as far as possible under the current circumstances.

Xie Chuntao mentioned that since the 18th National Congress, the central government has paid special attention to system construction, and the selection and appointment of cadres is a very important part of the central system. The new central government has put forward some new concepts and ideas, which need to be reflected and implemented in the regulations.

Ten hot spots in this revision

1 official morality

Highlight the investigation of political quality, virtue and ethics

On the basis of the "Regulations on Cadres" in 2002, the new "Regulations" promoted the investigation of officials’ moral integrity to the primary position. In addition to adhering to the general principle of meritocracy and having both ability and political integrity, it also puts forward the principle of selecting and appointing cadres with morality first.

In the investigation of cadres, the political quality, moral conduct, behavior and other aspects are highlighted. Strengthen the investigation of clean government, deeply understand the situation of observing the relevant provisions of honesty and self-discipline, maintaining noble sentiments and healthy tastes, being cautious, using power impartially, being honest and honest, not seeking personal gain, and strictly demanding relatives and staff around.

2 naked official phenomenon

The appointment and selection of cadres completely eliminates "naked officials"

At the end of last year, the Central Organization Department issued a notice calling for further improvement in the work of leading cadres reporting personal matters. It is clearly pointed out that leading cadres are not allowed to be promoted and appointed or included in the list of reserve cadres if they do not truthfully report their income, real estate and spouse’s children moving abroad.

In view of the phenomenon of "naked officials" that the masses abhor, the new "Regulations" put forward more clear and strict requirements, and all "spouses have moved abroad; Or if there is no spouse and the children have moved outside the country (territory), they shall not be included in the investigation. "

3 rocket promotion

Breaking the rules and promoting cadres needs to pass the critical test.

27-year-old deputy magistrate of Hunan, 22-year-old secretary of the Communist Youth League Committee of Anqing, 25-year-old female mayor of Shandong and vice mayor of post-80s beauty in Liaoning & HELIP; … In recent years, young cadres have been repeatedly exposed to "rocket promotion".

In view of the selection and appointment of young cadres and the promotion of cadres, the new "Regulations" clearly require that party and government leading cadres should be promoted step by step.

The promotion of cadres must be strict, and they must stand the test, make outstanding performance and make significant contributions at critical moments or undertake urgent and dangerous tasks; Outstanding performance in areas or units with difficult conditions, complex environment and poor foundation; Conscientious in other positions, and his work performance is particularly remarkable.

4 promotion in spite of illness

Officials who take the blame and resign are banned from promotion for two years.

The new "Regulations" clearly stated for the inspection of cadres that those who are affected by organizational treatment or disciplinary actions shall not be included in the inspection object.

At the same time, the new "Regulations" put forward stricter requirements for officials who resign, are ordered to resign and are dismissed due to problems: "Party and government leading cadres who resign, are ordered to resign and are dismissed due to accountability will not be assigned positions within one year, and they will not hold positions higher than their original positions for two years. At the same time, if it is subject to party discipline and political discipline, it shall be implemented in accordance with the provisions of the long-term impact period. "

5 resume fraud

Cadres’ academic records shall not be altered or falsified.

Last May, Liu Tienan, deputy director of the National Development and Reform Commission, was suspected of serious violation of discipline. Among the three problems he was reported, falsification of academic qualifications was one of them.

Like the "Regulations on Cadres" promulgated in 2002, the new "Regulations" also set 10 prohibitions on selecting cadres. Among them, Article 10 is a new item, which clearly states that it is not allowed to alter cadres’ files, or to falsify cadres’ identity, age, length of service, party age, education and experience.

6 radish official position

The conditions for setting cadres’ posts are set by people.

The new "Regulations" put forward that open selection and competition for posts are one of the ways to select and appoint leading cadres of the party and government. Open selection is open to the society, and competition for posts is carried out in the unit or within the system. We should proceed from reality and reasonably determine the selection positions, quantity and scope.

The conditions and qualifications set by the open selection and competition for posts shall not be set by individuals. If the qualification conditions exceed the requirements, it shall be reported to the superior organization (personnel) department for examination and approval in advance.

It is not allowed to promote leading cadres beyond the number of posts and institutional specifications, or to set job titles and improve the treatment of cadres without authorization in violation of regulations.

7 running officials and important officials

Running officials and canvassing officials are forbidden to list inspection targets.

The new "Regulations" require that those who are not included in the investigation also include those who run officials and canvass.

At the same time, it is also clearly stipulated that it is not allowed to take improper means to seek jobs for yourself or others, and it is not allowed to engage in non-organizational activities such as democratic recommendation, democratic evaluation, organization inspection and elections; It is not allowed to take advantage of his position to interfere with the selection and appointment of cadres at a lower level or in the original region or unit.

8 high above

Lack of grassroots experience requires "decentralization" exercise

从2012年开始,北京地区区县级机关录用公务员均需从具有两年以上基层工作经历的人员中考录。近年来,中国对于领导干部基层工作经历的考察越来越重视。

新《条例》明确将“应当树立注重基层的导向。”的要求列入选拔任用干部的基本原则。针对年轻干部,新《条例》提出:“经历单一或者缺少基层工作经历的年轻干部,应当有计划地到基层、艰苦边远地区和复杂环境工作。”

9 为官作懒

考察任命干部注重实绩成效

新《条例》提出,注重考察干部的工作实绩。考察地方党政领导班子成员,应当把有质量、有效益、可持续的经济发展和民生改善、社会和谐进步、文化建设、生态文明建设、党的建设等作为考核评价的重要内容,防止单纯以经济增长速度评定工作实绩。考察党政工作部门领导干部,应当把执行政策、营造良好发展环境、提供优质公共服务、维护社会公平正义等作为评价的重要内容。

10 用人失察

用人失察追责首列纪检机关

2012年,经过中央纪委检查,原重庆市委书记薄熙来严重违反党的纪律,在王立军事件和薄谷开来故意杀人案件中滥用职权,犯有严重错误、负有重大责任违反组织人事纪律,用人失察失误,造成严重后果。

In the new "Regulations" published yesterday, it was clearly pointed out that if the mistakes in employing people caused serious consequences, if the unhealthy practices in employing people in the local departments were serious, the cadres and the masses reacted strongly, and the behaviors that violated the organization’s personnel discipline were not investigated effectively, the main leading members of the party committee (party group), relevant leading members, relevant leading members of the organization (personnel) departments and discipline inspection and supervision organs, and other directly responsible persons should be investigated according to the specific circumstances.

Attachment: The full text of the Regulations on the Selection and Appointment of Leading Cadres of the Party and Government.

Regulations on the selection and appointment of party and government leading cadres

Chapter I General Provisions

Article 1 In order to conscientiously implement the Party’s line, principles and policies on cadres, implement the requirements of strictly administering the Party and cadres, establish a scientific and standardized system for selecting and appointing leading cadres of the Party and government, form an effective, simple and convenient mechanism for selecting and employing outstanding talents, promote the revolutionization, youthfulness, knowledge and specialization of cadres, and build a great banner of Socialism with Chinese characteristics. Guided by Marxism–Leninism, Mao Zedong Thought, Deng Xiaoping Theory, Theory of Three Represents and Scientific Outlook on Development, this Regulation is formulated in accordance with Constitution of the Communist Party of China and relevant laws and regulations, with a team of high-quality party and government leading cadres who are firm in belief, serve the people, diligent and pragmatic, dare to take responsibility, and are honest and clean.

Article 2 The selection and appointment of leading cadres of the Party and government must adhere to the following principles:

(a) the principle of party management of cadres;

(2) All corners of the country, the principle of meritocracy;

(3) The principle of having both ability and political integrity and putting morality first;

(4) The principle of paying attention to performance and being recognized by the masses;

(five) the principles of democracy, openness, competition and merit;

(6) The principle of democratic centralism;

(seven) the principle of handling affairs according to law.

Article 3 The selection and appointment of party and government leading cadres must meet the requirements of building the leading group into a leading group that adheres to the party’s basic theory, line, program, experience and requirements, serves the people wholeheartedly, has the ability to lead the socialist modernization drive, and is reasonable in structure, united and strong.

We should pay attention to training and selecting outstanding young cadres, using reserve cadres and making good use of cadres of all ages.

We should establish a grass-roots orientation.

Article 4 These Regulations shall apply to the selection and appointment of leading members of internal organs of the Central Committee of the Communist Party of China, the National People’s Congress Standing Committee (NPCSC), the State Council, Chinese People’s Political Consultative Conference, departments or organs of the Central Commission for Discipline Inspection, leading members of the Supreme People’s Court and the Supreme People’s Procuratorate (excluding full-time positions) and leading members of internal organs; Leading members of local party committees at or above the county level, the Standing Committee of the National People’s Congress, the government, the CPPCC, the Commission for Discipline Inspection, the people’s courts, the people’s procuratorates and their departments or organs; The leading members of the institutions in the above-mentioned work departments.

Where there are other provisions in laws, regulations and policies on the selection and appointment of party and government leading cadres in ethnic autonomous areas, those provisions shall prevail.

The selection and appointment of leading members of party committees and institutions directly under the government at or above the county level, trade unions, the Communist Youth League, women’s federations and other people’s organizations and their internal institutions, which are governed by the Civil Service Law, shall be implemented with reference to these regulations.

The selection and appointment of non-CPC party member leading cadres and non-leading cadres at or above the division level by the above-mentioned organs and units shall be implemented with reference to these regulations.

Article 5 The provisions of this Ordinance shall apply to the election and appointment and removal of party and government leading posts within the scope listed in Article 4 of this Ordinance, and the generation of candidates recommended and nominated by party organizations, and their election and appointment and removal according to law shall be conducted in accordance with relevant laws, articles of association and regulations.

Party committees (party groups) and their organizations (personnel) departments shall perform the duties of selecting and appointing leading cadres of the party and government in accordance with the cadre management authority, and be responsible for organizing the implementation of these regulations.

Chapter II Selection and Appointment Conditions

Article 7 Party and government leading cadres shall meet the following basic conditions:

(1) Consciously adhere to the guidance of Marxism–Leninism, Mao Zedong Thought, Deng Xiaoping Theory, Theory of Three Represents and Scientific Outlook on Development, strive to analyze and solve practical problems with Marxist standpoints, viewpoints and methods, persist in stressing study, politics and righteousness, maintain a high degree of consistency with the CPC Central Committee ideologically, politically and practically, and stand the test of various storms.

(2) Have lofty ideals of communism and firm belief in Socialism with Chinese characteristics, resolutely implement the Party’s basic line and various principles and policies, be determined to reform and open up, devote themselves to the cause of modernization, work hard in socialist construction, establish a correct outlook on political achievements, and make achievements that can stand the test of practice, people and history.

(3) Persist in emancipating the mind, seeking truth from facts, advancing with the times, seeking truth from facts and being pragmatic, and earnestly investigate and study, so that we can combine the Party’s principles and policies with the actual situation of our local departments, carry out our work effectively, tell the truth, do practical things, seek practical results and oppose formalism.

(four) have a strong sense of revolutionary dedication and political responsibility, practical experience, organizational ability, cultural level and professional knowledge.

(5) correctly exercise the rights entrusted by the people, adhere to principles, dare to grasp and manage, act according to law, be honest and honest, work diligently for the people, set an example, be hard-working and frugal, keep close contact with the masses, adhere to the party’s mass line, consciously accept criticism and supervision from the party and the masses, strengthen moral cultivation, stress party spirit, pay attention to conduct, set an example, take the lead in practicing socialist core values, and achieve self-respect, introspection and self-respect.

(6) Adhere to and safeguard the party’s democratic centralism, have a democratic style of work, have an overall concept, and be good at uniting comrades, including those who have different opinions.

Article 8 A person who is promoted to a leading position in the Party and government shall meet the following basic qualifications:

(a) to be appointed as a county-level leadership position, it shall have more than five years of service and more than two years of grassroots work experience.

(2) Those who are promoted to leadership positions at or above the county level shall generally have the experience of holding two or more positions at the next level.

(3) If a deputy is promoted to a leading position at or above the county level, he shall work in a deputy position for more than two years, and if a subordinate principal is promoted to a superior deputy position, he shall work in a subordinate principal position for more than three years. The number of years of appointment to non-leadership positions at or above the division level shall be implemented in accordance with relevant regulations.

(4) Generally speaking, they should have a college degree or above, among which leading cadres at or above the bureau level should generally have a bachelor degree or above.

(5) It shall be trained by Party schools, administrative colleges, cadre colleges or other training institutions recognized by the organization (personnel) department, and the training time shall meet the relevant requirements of cadre education and training. If the training requirements are not met before the appointment due to special circumstances, the training shall be completed within one year after the appointment.

(6) Having physical conditions for normal performance of duties.

(seven) meet the qualification requirements stipulated by relevant laws. Those who are appointed to the leadership positions of the Party shall also meet the requirements of party age stipulated in Constitution of the Communist Party of China.

Article 9 Party and government leading cadres should be promoted step by step. Cadres who are particularly outstanding or have special work needs can break through the qualification requirements or be promoted to leadership positions.

Exceptionally promoted outstanding cadres should have outstanding ability and political integrity, be highly recognized by the masses, and meet one of the following conditions: stand the test at a critical moment or undertake urgent and dangerous tasks, make outstanding performance, and make significant contributions; Outstanding performance in areas or units with difficult conditions, complex environment and poor foundation; Conscientious in other positions, and his work performance is particularly remarkable.

Cadres who are promoted by breaking the rules due to special work needs shall meet one of the following circumstances: the leadership structure needs or the leadership position has special requirements; Professional positions or important special work are urgently needed; Difficult and remote areas and poverty-stricken areas are in urgent need of introduction.

Promoting cadres by breaking the rules must be strictly controlled. Shall not exceed the basic conditions stipulated in Article 7 and the qualification requirements stipulated in Item 7 of Article 8 of these Regulations. If the probation period is not full or the promotion is less than one year, it shall not be promoted without exception. Do not continuously break the rules in the number of years of service. You can’t be promoted above two levels.

Article 10 Broaden the horizons and channels for selecting candidates. Party and government leading cadres can be selected and appointed from party and government organs or from outside party and government organs. Members of local party and government leading bodies should pay attention to the selection of cadres who have held party and government leading positions in counties (cities, districts and banners) and townships (towns and streets) and leaders of state-owned enterprises and institutions.

Chapter III Motion

Eleventh party committees (party groups) or organizations (personnel) departments in accordance with the cadre management authority, according to the needs of the work and the actual construction of leading bodies, put forward opinions on starting the selection and appointment of cadres.

The organization (personnel) department comprehensively understands the situation in peacetime according to the suggestions of relevant parties, analyzes and judges the leading bodies, and puts forward preliminary suggestions on the positions, conditions, scope, methods and procedures for selection and appointment.

Thirteenth preliminary suggestions to the main leading members of the party committee (party) report, in a certain range of brewing, forming a work plan.

Chapter IV Democratic Recommendation

Article 14 the selection and appointment of leading cadres of the party and government must be recommended by democracy. Democratic recommendation includes meeting recommendation and individual conversation recommendation, and the recommendation result is an important reference for selection and appointment, which is valid within one year.

Fifteenth leadership changes, democratic recommendation in accordance with the position setting full directional recommendation; Individual promotion, according to the proposed post recommendation.

Sixteenth leadership transition, democratic recommendation shall be presided over by the Party committee (Party) at the same level, shall go through the following procedures:

(a) held a recommendation meeting, announced the recommended positions, qualifications, recommended scope, provide a roster of cadres, put forward relevant requirements, and organize to fill in the recommendation form;

(two) to recommend individual conversations;

(three) a comprehensive analysis of the recommendation of the meeting and the recommendation of the conversation;

(four) to report the recommendation to the higher party committee.

Seventeenth leadership transition, the meeting recommended by the following personnel to participate in:

(1) Members of Party committees;

(two) members of the Standing Committee of the National People’s Congress, the government, and the leading members of the CPPCC;

(3) Leading members of the Commission for Discipline Inspection;

(4) Leading members of people’s courts and people’s procuratorates;

(5) Leading members of Party committees, government departments and people’s organizations;

(six) the main leading members of the Party committee and government at the next lower level;

(seven) other personnel who need to participate.

To recommend candidates for leading members of the Standing Committee of the National People’s Congress, the government and the CPPCC, there should be leading members of democratic parties, the Federation of Industry and Commerce and representatives without party affiliation.

The persons recommended to participate in individual conversations are determined with reference to the above range and can be adjusted appropriately.

Eighteenth leadership changes, according to the recommendations of the meeting, individual talks and the needs of the leadership structure, you can put forward a preliminary list for the second meeting. The second meeting is recommended to be attended by the following persons:

(1) Members of Party committees;

(two) members of the Standing Committee of the National People’s Congress, the government, and the leading members of the CPPCC;

(3) Leading members of people’s courts and people’s procuratorates;

(4) Deputy Secretary of the Commission for Discipline Inspection;

(5) Other personnel who need to attend.

Article 19 The democratic recommendation procedure for individual promotion and appointment can be carried out with reference to the provisions of Articles 16 and 18 of these Regulations, or individual talk recommendation can be made first, and then a preliminary list is put forward by the party committee (party group) or the organization (personnel) department according to the talk, and then the meeting recommendation can be made.

Twentieth individual promotion, to participate in democratic recommendation personnel according to the following scope:

(a) democratic recommendation of local party and government leadership candidates, with reference to the provisions of this Ordinance seventeenth, eighteenth, can be appropriately adjusted.

(two) the democratic recommendation of the leading members of the working department, the meeting recommended by the leading members of the department, the leading members of the internal organs, the leading members of the directly affiliated units and other personnel who need to participate; If the number of people in this department is small, it can be attended by all staff. According to the actual situation, it can also attract the main leading members of the subordinate units of this system to participate. The persons recommended to participate in individual conversations are determined with reference to the above range and can be adjusted appropriately.

(3) The candidates for leading members of democratically recommended internal organs shall be determined with reference to the scope listed in the preceding paragraph.

Twenty-first individuals to recommend leading cadres to the party organization, must be responsible for writing the recommendation materials and signature. If the recommended candidate meets the requirements after being audited by the organization (personnel) department, it will be included in the scope of democratic recommendation, and if it lacks the basis of public opinion, it will not be listed as the object of investigation.

Twenty-second party committees, governments and their departments with individual special needs of leading members can be recommended by the party Committee (party group) or the organization (personnel) department and reported to the superior organization (personnel) department for approval as the object of investigation.

Chapter V Investigation

Article 23 To determine the object of investigation, we should comprehensively consider democratic recommendation, peacetime assessment, annual assessment, consistent performance and suitability of people and posts according to the needs of work and the ability and integrity of cadres, and fully brew to prevent the recommended votes from being equated with electoral votes and simply taking people by recommended votes.

Twenty-fourth any of the following circumstances shall not be listed as the object of investigation:

(a) the recognition of the masses is not high.

(two) in the past three years, the annual assessment results have been determined to be basically competent.

(three) there are acts of running away from officials and canvassing.

(4) The spouse has moved abroad; Or there is no spouse, and all the children have moved abroad.

(five) affected by the organization or disciplinary action.

(six) other reasons are not suitable for promotion.

Article 25 During the change of leadership, the party secretary and deputy secretary at the corresponding level, the standing committee in charge of organization and discipline inspection, etc. will brew the candidates for inspection according to the feedback from the organization department of the higher-level party committee, and the standing committee of the party committee at the corresponding level will study and put forward the suggested list of inspection objects, and then determine the inspection objects after communicating with the organization department of the higher-level party committee. The object of investigation of the new party and government leading bodies should be publicized within a certain range.

Individual promotion, by the party committee (party) to study and determine the object of investigation.

Generally speaking, the number of people to be investigated should be more than the number of people to be appointed.

Twenty-sixth to determine the object of investigation, by the organization (personnel) departments in accordance with the cadre management authority to conduct a strict inspection.

Department and local dual management cadres inspection work, by the competent party responsible for, in conjunction with the coordinator.

Twenty-seventh to inspect the candidates for leading positions of the party and government, we must comprehensively inspect their morality, ability, diligence, performance and honesty according to the conditions of selecting and appointing cadres and the requirements of different leadership positions.

Highlight the investigation of political quality and moral conduct, and gain an in-depth understanding of ideals and beliefs, political discipline, adherence to principles, courage to take responsibility, criticism and self-criticism, and conduct.

Pay attention to the investigation of work performance, in-depth understanding of the actual results of fulfilling job responsibilities, promoting and serving scientific development. To inspect the members of local party and government leading bodies, we should take quality, effective and sustainable economic development and improvement of people’s livelihood, social harmony and progress, cultural construction, ecological civilization construction and party building as the important contents of assessment and evaluation, pay more attention to the assessment of labor and employment, residents’ income, scientific and technological innovation, education and culture, social security, health and health, strengthen the assessment of binding indicators, and increase resource consumption, environmental protection, digestion of overcapacity, safety production and so on. Inspection of leading cadres in party and government departments should take the implementation of policies, creating a good development environment, providing high-quality public services and maintaining social fairness and justice as important contents of evaluation.

Strengthen the investigation of work style, deeply understand the situation of serving the people, seeking truth and being pragmatic, diligent and dedicated, striving for success, and opposing formalism, bureaucracy, hedonism and extravagance.

Strengthen the investigation of clean government, deeply understand the situation of observing the relevant provisions of honesty and self-discipline, maintaining noble sentiments and healthy tastes, being cautious, using power impartially, being honest and honest, not seeking personal gain, and strictly demanding relatives and staff around.

Party committees (party groups) at all levels shall, according to the actual situation, formulate specific inspection standards.

Twenty-eighth inspection of the candidates for party and government leadership positions shall ensure sufficient inspection time and go through the following procedures:

(1) Organizing the inspection team and formulating the inspection work plan;

(two) with the inspection object reporting unit or the main leading members of the party committee (party group) of the unit to solicit opinions on the communication of the inspection work plan;

(three) according to the different conditions of the object of investigation, through appropriate means to release the notice of inspection of cadres in a certain range;

(4) Take individual talks, distribute consultation forms, democratic evaluation, on-the-spot visits, consult cadres’ files and work materials, interview with the subjects, etc. to gain a broad and in-depth understanding of the situation, and conduct public opinion surveys, special surveys and extended inspections as needed;

(five) comprehensive analysis of the investigation, and the consistent performance of the object of investigation are compared and mutually confirmed, and the object of investigation is comprehensively and accurately evaluated;

(six) to report the investigation to the unit or the main leading members of the party Committee (party group) of the unit, and exchange views;

(7) The inspection team studies and puts forward suggestions on the appointment of candidates, reports to the organization (personnel) department that sent the inspection team, puts forward the appointment proposal through collective research by the organization (personnel) department, and reports to the Party committee (party group) at the corresponding level.

Twenty-ninth inspection of local party and government leading group members to be candidates, the scope of individual talks and comments is generally:

(1) Leading members of Party committees and governments, leading members of the Standing Committee of the National People’s Congress, the Chinese People’s Political Consultative Conference, the Commission for Discipline Inspection, the people’s courts and the people’s procuratorates;

(two) leading members of the unit where the object of investigation is located;

(three) the main leading members of the relevant departments or internal institutions and directly affiliated units of the unit where the object of investigation is located;

(4) Other relevant personnel.

Thirtieth inspection departments leading group members to be candidates, the scope of individual conversation and advice is generally:

(a) the relevant leading members of the superior leading organs of the object of investigation;

(two) leading members of the unit where the object of investigation is located;

(three) the main leading members of the internal organs and directly affiliated units of the unit where the object of investigation is located;

(4) Other relevant personnel.

Investigate the candidates for leadership positions in internal institutions, and refer to the above provisions for the scope of individual talks and opinions.

Article 31 When inspecting the candidates for leading positions of the party and government, we should listen to the opinions of the organization (personnel) department, discipline inspection and supervision organs and party organizations, and we can listen to the opinions of inspection agencies and other relevant departments if necessary.

The organization (personnel) department shall listen to the opinions of the discipline inspection and supervision organs on the party style and clean government of the inspected object. For the object to be promoted, the report on personal matters shall be consulted and verified when necessary. The object of investigation that needs economic responsibility audit shall be entrusted to the audit department for audit in accordance with the relevant provisions.

Thirty-second inspection of candidates for party and government leadership positions must form written inspection materials and establish inspection documents and files. Those who have already served, the inspection materials are included in my file. Investigation materials must be realistic, comprehensive, accurate and clearly reflect the situation of the object of investigation, including the following contents:

(a) the main performance and main strengths of virtue, ability, diligence, performance and honesty;

(2) Main shortcomings and deficiencies;

(3) Democratic recommendation, democratic evaluation, etc.

Thirty-third party committees (party groups) or organizations (personnel) sent by the inspection team composed of two or more members. Investigators should have higher quality and corresponding qualifications. The person in charge of the inspection team should be a person with good ideological and political quality, rich work experience and familiarity with cadre work.

Implement the responsibility system for inspection of cadres. The inspection team must adhere to the principle, be fair and upright, be thorough and meticulous, truthfully reflect the inspection situation and opinions, be responsible for the inspection materials, and perform the duties of supervising the selection and appointment of cadres.

Chapter VI Discussion and Decision

Thirty-fourth candidates for leading positions of the party and government should be brewed among relevant leading members of the Party Committee (Party Group), the Standing Committee of the National People’s Congress, the government, the Chinese People’s Political Consultative Conference and so on according to the different situations of the positions and candidates before discussing and deciding to submit them.

The candidates for the leading members of the working department shall solicit the opinions of the leading members at higher levels.

Party member, a non-CPC candidate, shall solicit the opinions of the United Front Work Department of the Party Committee, the leading members of the democratic parties, the Federation of Industry and Commerce and representatives without party affiliation.

The appointment and removal of cadres with dual management of departments and localities shall be made by the competent party in advance to solicit the opinions of the co-managers. Comments are generally in written form. If the coordinator fails to reply within one month from the date of receiving the opinions of the competent party, it shall be deemed as consent. When the two sides disagree, the appointment and removal of the principal shall be reported to the organization department of the higher party committee for coordination, and the appointment and removal of the deputy shall be decided by the competent party.

Thirty-fifth selection and appointment of leading cadres of the party and government, should be in accordance with the cadre management authority by the party committee (party) collective discussion to make the appointment and removal decision, or decided to put forward recommendations and nominations. Belonging to the management of the superior party Committee (party group), the party Committee (party group) at the corresponding level may put forward suggestions on selection and appointment.

Before discussing and deciding on the candidate to be promoted without exception, it must be reported to the superior organization (personnel) department for approval. Those who are promoted by leaps and bounds or listed as candidates for promotion without democratic recommendation shall report before the inspection and be approved by the approval.

Article 36 The candidates to be appointed and recommended for the positions of Party committees and government leading bodies in cities (prefectures, leagues) and counties (cities, districts and banners) shall generally be nominated by the Standing Committee of Party committees at higher levels and submitted to the whole committee for voting by secret ballot; If the National Committee is in urgent need of appointment when it is not in session, the Standing Committee of the Party Committee shall make a decision, and the opinions of the members of the National Committee shall be sought before making a decision.

Thirty-seventh party committees (leading groups) to discuss and decide the appointment and dismissal of cadres, more than two-thirds of the members must attend the meeting, and ensure that the members attending the meeting have enough time to listen to the briefing and fully express their opinions. Members attending the meeting shall express clear opinions on the appointment and dismissal, such as agreement, disagreement or postponement. On the basis of full discussion, vote by oral vote, show of hands or secret ballot.

If the decision of the Party Committee (Party Group) on the appointment and removal of cadres needs reconsideration, it shall be approved by more than half of the members of the Party Committee (Party Group).

Article 38 Party committees (leading groups) shall discuss and decide on the appointment and removal of cadres in accordance with the following procedures:

(1) The leading members of the Party Committee (Party Group) in charge of the organization (personnel) work or the person in charge of the organization (personnel) department shall introduce the recommendation, inspection and reasons for appointment and removal of candidates for leadership positions one by one, and the specific circumstances and reasons for abnormality shall be explained;

(two) to participate in the meeting to fully discuss;

(three) to vote, with more than half of the members of the party Committee (party group) should agree to form a decision.

Article 39 The cadres to be promoted who need to be reported to the higher-level Party Committee (Party Group) for approval must be reported to the Party Committee (Party Group) for instructions and attached with the approval form for appointment and removal of cadres, inspection materials for cadres, personal files, minutes of meetings of the Party Committee (Party Group), discussion records, democratic recommendation and other materials. The superior organization (personnel) department shall strictly examine the submitted materials.

Cadres who need to be reported to their superiors for the record shall, in accordance with the provisions, file with the superior organization (personnel) department in a timely manner.

Chapter VII Appointment

Fortieth party and government leadership positions shall be appointed by appointment system, and some professional leadership positions may be appointed by appointment system. The appointment method shall be stipulated separately.

Forty-first the implementation of the party and government leading cadres before taking office publicity system.

Those who are promoted to leadership positions below the bureau level shall be publicized within a certain range after discussion and decision by the Party Committee (Party Group) and before the appointment notice is issued, except for special positions and candidates who have been publicized during the general inspection. The contents of publicity shall be true and accurate, which is convenient for supervision. If it involves exceptional promotion, it shall also explain the specific circumstances and reasons for exceptional promotion. The publicity period is not less than five working days. If the publicity results do not affect the appointment, the appointment procedures shall be handled.

Forty-second the implementation of the probation system for leading cadres of the party and government.

The probation period is one year for those who are promoted to the following non-elected leadership positions below the bureau level:

(a) the Party committee, the Standing Committee of the National People’s Congress, the government, the CPPCC work department deputy and internal organs leadership positions;

(two) the leadership position of the internal organs of the Commission for Discipline Inspection;

(3) Leading positions appointed by organs of non-state power with internal organs of people’s courts and people’s procuratorates according to law.

After the expiration of the probation period, those who are qualified for their current posts after examination will formally take up their posts; If you are incompetent, you will be exempted from the post of trial appointment, and generally work will be arranged according to the rank before trial appointment.

Article 43 The post-holding talk system shall be implemented. For the cadres who decide to appoint, the Party Committee (Party Group) shall designate a special person to talk with me, affirm the achievements, point out the shortcomings, put forward the requirements and problems that need attention.

Forty-fourth party and government leadership positions, according to the following time calculation:

(a) by the party committee (party) decided to serve, from the date of the decision of the party committee (party);

(2) If the appointment is decided by the Party Congress, the plenary session of the Party Committee, the plenary session of the Party’s Commission for Discipline Inspection, the people’s congress and the plenary session of the Chinese People’s Political Consultative Conference, it shall be counted from the date of election and decision on appointment;

(three) appointed or decided by the Standing Committee of the National People’s Congress or the Standing Committee of the Chinese People’s Political Consultative Conference, counting from the date of the appointment or decision of the Standing Committee of the National People’s Congress or the Standing Committee of the Chinese People’s Political Consultative Conference;

(four) nominated by the party committee to the government for appointment by the government, counting from the date of government appointment.

Chapter VIII Recommendation, nomination and democratic consultation according to law

Article 45 When recommending candidates for leading cadres to the People’s Congress or its Standing Committee who need to be elected, appointed or decided by the People’s Congress or its Standing Committee, the Party Committee shall introduce the Party Committee’s recommendation to party member, a temporary Party organization of the People’s Congress or a member of the Party group and the Standing Committee of the People’s Congress. Party member, a temporary Party organization of the People’s Congress, a party group of the Standing Committee of the National People’s Congress, members of the Standing Committee of the National People’s Congress and deputies to the National People’s Congress, should conscientiously implement the recommendations of the Party Committee, take the lead in handling affairs according to law, and correctly perform their duties.

Article 46 When recommending to the people’s congress candidates for leading cadres elected and appointed by the people’s congress, the party committee shall submit a recommendation letter to the presidium of the people’s congress in the name of the party committee at the corresponding level, introducing the relevant information of the recommended candidates and explaining the reasons for the recommendation.

The Party Committee shall recommend to the Standing Committee of the National People’s Congress the candidates for leading cadres appointed and decided by the Standing Committee of the National People’s Congress, and shall, before deliberation by the Standing Committee of the National People’s Congress, put forward in accordance with the prescribed procedures and introduce the relevant information of the recommended candidates.

Article 47 The Party Committee shall nominate to the government the candidates for leading members of government departments and institutions appointed by the government, and the candidates shall be appointed by the government after discussion and decision by the Party Committee.

Article 48 When the leadership changes, the Party committee recommends the candidates of the Standing Committee of the National People’s Congress, the government, the leading members of the Chinese People’s Political Consultative Conference, the presidents of the people’s courts and the chief procurators of the people’s procuratorates, and shall inform the leading members of the democratic parties, the Federation of Industry and Commerce and representatives without party affiliation of the relevant information in advance and conduct democratic consultations.

Article 49 Before the election or appointment of the leading cadres recommended by the Party Committee or the appointment or decision of the Standing Committee of the National People’s Congress, if the deputies to the National People’s Congress or members of the Standing Committee of the National People’s Congress put forward different opinions on the recommended candidates, the Party Committee shall carefully study them and make necessary explanations or explanations. If it is found that there is a factual basis that can affect the election or appointment, the Party Committee may suggest that the People’s Congress or the Standing Committee of the National People’s Congress suspend the election, appointment and decision on appointment in accordance with the prescribed procedures, or re-recommend candidates.

The recommendation and nomination of candidates for leading members of the CPPCC shall be handled in accordance with the articles of association and relevant regulations of the CPPCC.

Chapter IX Open Selection and Competition for Posts

Fiftieth open selection and competition for posts is one of the ways to select and appoint leading cadres of the party and government. Open selection is open to the society, and competition for posts is carried out in the unit or within the system. We should proceed from reality and reasonably determine the selection positions, quantity and scope. Under normal circumstances, if there are vacancies in leadership positions and there are no suitable candidates in this department, especially those who need to supplement the shortage of professionals, they can be openly selected; If there is a vacancy in the leadership position, and there are a large number of qualified people in this unit and the opinions of candidates are not easy to concentrate, they can compete for posts.

Open selection of leading cadres below the county level is generally not carried out across provinces (autonomous regions and municipalities directly under the central government).

Article 51 The conditions and qualifications set in the scheme of open selection and competition for posts shall conform to the provisions of Articles 7 and 8 of these Regulations, and qualification conditions shall not be set for individuals. If the qualification conditions exceed the requirements, it shall be reported to the superior organization (personnel) department for examination and approval in advance.

Fifty-second open selection, competition for posts under the leadership of the Party committee (Party), organized by the organization (personnel) department, shall go through the following procedures:

(a) announced the position, qualifications, basic procedures and methods;

(two) registration and qualification examination, to participate in the open selection shall be approved by the unit;

(three) to take appropriate measures to test and evaluate the ability and quality, which is better than choosing (democratic recommendation can also be made first in competition for posts);

(4) Organizing inspection, studying and proposing candidate schemes;

(five) the party committee (party) to discuss and decide;

(6) Fulfilling the post-holding procedures.

Fifty-third open selection, competition for posts should be scientific and standardized testing, evaluation, highlighting the characteristics of posts, highlighting performance competition, focusing on ability and quality and consistent performance, to prevent people from simply taking scores.

Chapter X Communication and Avoidance

Fifty-fourth the implementation of the party and government leading cadres exchange system.

(1) The objects of communication are mainly: those who need to communicate because of work; Need to improve leadership through communication and exercise; Working in a place or department for a long time; In accordance with the provisions of the need to avoid; Need to communicate for other reasons.

The focus of the exchange is the leading members of local party committees and governments at or above the county level, and the leading members of discipline inspection commissions, people’s courts, people’s procuratorates, party committees and some government departments.

(2) Leading members of local party committees and governments shall, in principle, serve for one term, and those who have served in the same position for ten years must communicate; Those who have served in the same position for two consecutive terms will no longer be recommended, nominated or appointed to the same position.

Party and government posts in the same place (department) are generally exchanged at different times.

(3) If the leading cadres at or above the division level in the party and government organs have served in the same position for a long time, they shall conduct exchanges or rotate their posts.

(four) young cadres who have a single experience or lack of grassroots work experience should work in grassroots, hard and remote areas and complex environments in a planned way.

(5) Strengthen the overall exchange of cadres. Promote the exchange of cadres between regions, departments, localities and departments, party and government organs and state-owned enterprises and institutions and other social organizations.

(six) the exchange of cadres shall be organized and implemented by the Party Committee (Party Group) and its organization (personnel) departments in accordance with the management authority of cadres, and the qualifications of candidates shall be strictly grasped. Individual cadres are not allowed to contact and exchange matters by themselves, and leading cadres are not allowed to designate exchange candidates. The same cadre should not communicate frequently.

(seven) exchange of cadres after receiving the notice of appointment, should be in the party committee (party) or organization (personnel) department within the time limit. Cross-regional and cross-departmental exchanges should also transfer administrative relations, wage relations and party organizational relations.

Fifty-fifth the implementation of the party and government leading cadres appointment avoidance system.

The kinship relationships that party and government leading cadres avoid when taking office are: husband and wife, lineal consanguinity, collateral consanguinity within three generations and close affinity. Those who have the above kinship shall not hold positions directly subordinate to the same leader or directly subordinate to the next higher level in the same organ, nor shall they engage in organization (personnel), discipline inspection and supervision, auditing and financial work in the organ where one of them holds leadership positions.

Leading cadres may not serve as full-time leading members of county (city) party committees and governments, discipline inspection organs, organizational departments, people’s courts, people’s procuratorates and public security departments where they grew up, and generally may not serve as full-time leading members of city (prefecture) party committees and governments, discipline inspection organs, organizational departments, people’s courts, people’s procuratorates and public security departments where they grew up.

Fifty-sixth the implementation of the party and government leading cadres selection and appointment work avoidance system.

Party committees (party groups) and their organizations (personnel) departments discuss the appointment and dismissal of cadres, which involves the participants themselves and their relatives, and I must withdraw.

If a member of the cadre inspection team involves his relatives in the cadre inspection work, I must withdraw.

Chapter XI Dismissal, Resignation and Demotion

Fifty-seventh party and government leading cadres in any of the following circumstances, generally should be removed from their current posts:

(a) reached the age limit or retirement age limit.

(2) Those who should be dismissed after being investigated for responsibility.

(3) Resignation or transfer.

(four) non-organization selection, leaving school for more than one year.

(five) due to work needs or other reasons, should be removed from the current position.

Article 58 the system of resignation of leading cadres of the party and government shall be implemented. Resignation includes resignation in the line of duty, voluntary resignation, taking the blame and ordering resignation.

Resignation shall comply with the relevant provisions, and the procedures shall be handled in accordance with the law or relevant provisions.

Article 59 Party and government leading cadres who take the blame and resign, are ordered to resign, and are dismissed due to accountability shall not be assigned to their posts within one year, and shall not hold posts higher than their original posts within two years. At the same time, it is subject to disciplinary sanctions, which shall be implemented in accordance with the provisions on a long period of influence.

Article 60 the system of demotion of leading cadres of the party and government shall be implemented. Party and government leading cadres who are determined to be incompetent in the annual assessment, who are not suitable for the current post level because of their weak working ability, organizational treatment or other reasons, should be demoted and used. Demoted cadres shall be treated according to the standards of new posts.

Demoted cadres are promoted again, in accordance with relevant regulations.

Chapter XII Discipline and Supervision

Article 61 The selection and appointment of party and government leading cadres must strictly implement the provisions of these Regulations and observe the following disciplines:

(a) are not allowed to exceed the number of positions, institutions and specifications to promote leading cadres, or in violation of the provisions of the unauthorized setting of job titles, improve the treatment of cadres;

(two) are not allowed to take unfair means to seek positions for themselves or others;

(three) are not allowed to recommend, inspect, discuss and decide the appointment and removal of cadres in violation of the prescribed procedures;

(four) are not allowed to privately disclose the motion, democratic recommendation, democratic evaluation, inspection, brewing, discussion and decision of cadres and other relevant information;

(five) are not allowed to conceal or distort the truth in the inspection work of cadres;

(six) are not allowed to engage in non-organizational activities such as canvassing in democratic recommendation, democratic evaluation, organization inspection and elections;

(seven) it is not allowed to take advantage of his position to interfere with the selection and appointment of cadres at a lower level or in the original working area or unit;

(8) It is not allowed to promote or adjust cadres by surprise when the work is transferred or the organization changes;

(nine) are not allowed to make a vow in the selection and appointment of cadres, cronyism, corruption;

(ten) are not allowed to alter the cadre files, or in the cadre’s identity, age, length of service, party age, education, experience and other aspects of fraud.

Sixty-second strengthen the supervision of the whole process of cadre selection and appointment, and seriously investigate and deal with violations of organizational personnel discipline. In violation of the provisions of this Ordinance, in accordance with the relevant provisions of the party committee (party) leading members and relevant leading members, leading members of the organization (personnel) department and other directly responsible persons to make organizational treatment or disciplinary action.

Those who refuse to obey the decision of organization transfer or exchange without justifiable reasons shall be dismissed or demoted in accordance with laws and relevant regulations.

Article 63 the system of accountability for the selection and appointment of leading cadres of the party and government shall be implemented. Where the negligence of employing people causes serious consequences, the unhealthy trend of employing people in this region is serious, the cadres and the masses strongly reflect it, and the behavior of violating the organization and personnel discipline is not investigated effectively, the main leading members of the party Committee (party group), relevant leading members, relevant leading members of the organization (personnel) department and the discipline inspection and supervision organs and other directly responsible persons shall be held accountable according to the specific circumstances.

Article 64 The Party Committee (Party Group) and its organization (personnel) departments shall supervise and inspect the selection and appointment of cadres and the implementation of these Regulations, accept reports and complaints about the selection and appointment of cadres, stop and correct violations of these Regulations, and put forward handling opinions or suggestions to the responsible persons concerned.

Discipline inspection and supervision organs and inspection agencies shall, in accordance with relevant regulations, supervise and inspect the selection and appointment of cadres.

Article 65 The organization (personnel) department shall implement the system of joint meeting with the discipline inspection and supervision organs and other relevant units, and put forward opinions and suggestions on strengthening supervision over the selection and appointment of cadres, communicating information and exchanging information. The joint meeting shall be convened by the organization (personnel) department.

Article 66 Party committees (leading groups) and their organizational (personnel) departments must strictly implement these regulations in the selection and appointment of cadres, and consciously accept organizational supervision and mass supervision. Organs at lower levels and party member, cadres and the masses have the right to report and complain to the Party committees (leading groups) at higher levels and their organizational (personnel) departments and discipline inspection and supervision organs, and the accepting departments and organs shall check and handle them in accordance with relevant regulations.

Chapter XIII Supplementary Provisions

Article 67 The provisions of these Regulations on working departments shall also apply to offices, dispatched offices, ad hoc organizations and other directly affiliated institutions.

Article 68 The Party committees of provinces, autonomous regions and municipalities directly under the Central Government shall formulate corresponding implementation measures in accordance with these Regulations for the selection and appointment of leading party and government cadres in townships (towns, streets).

Article 69 Measures for the selection and appointment of leading cadres of the China People’s Liberation Army and the Chinese People’s Armed Police Force shall be formulated by the Central Military Commission (CMC) in accordance with the principles of these Regulations.

Article 70 The Organization Department of the CPC Central Committee shall be responsible for the interpretation of these Regulations.

Article 71 These Regulations shall come into force as of the date of promulgation. The Regulations on the Selection and Appointment of Leading Cadres of the Party and Government issued by the Central Committee of the Communist Party of China on July 9, 2002 shall be abolished at the same time.

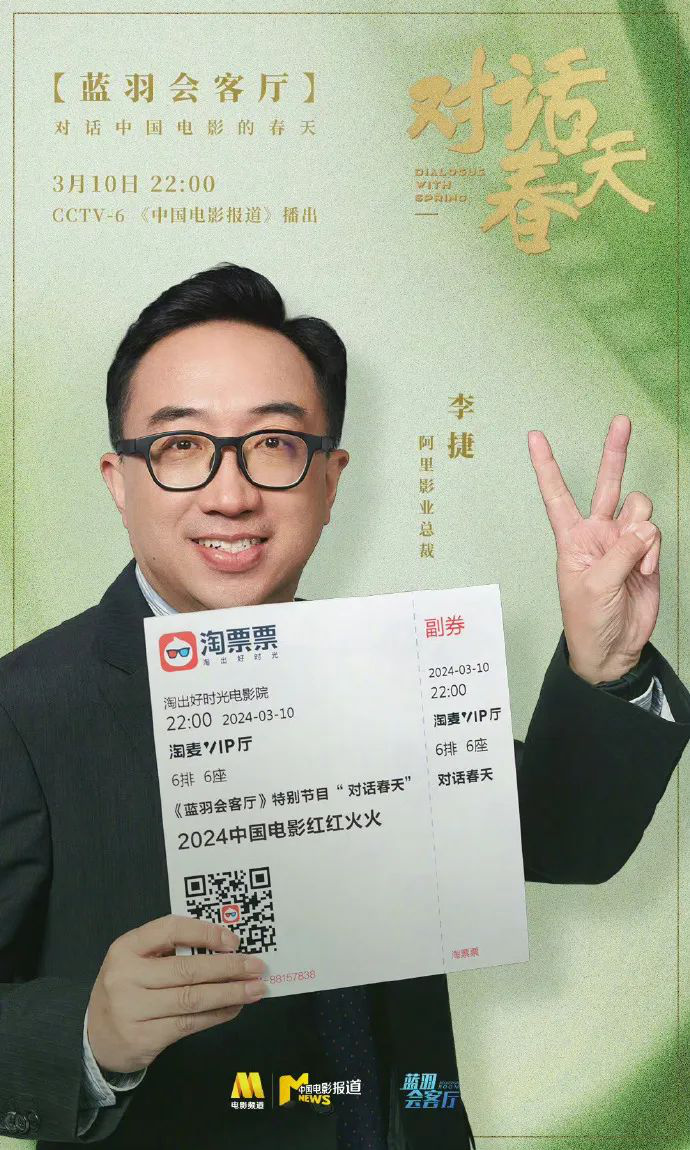

Click to watch: "Blue Feather Living Room" special program of the two sessions | "Dialogue Spring": Fu Ruoqing, head of China Film

Click to watch: "Blue Feather Living Room" special program of the two sessions | "Dialogue Spring": Fu Ruoqing, head of China Film

Click to watch: "Blue Feather Living Room" special program of the two sessions | "Dialogue Spring": Huaxia movie Hai Cheng Zhao

Click to watch: "Blue Feather Living Room" special program of the two sessions | "Dialogue Spring": Huaxia movie Hai Cheng Zhao

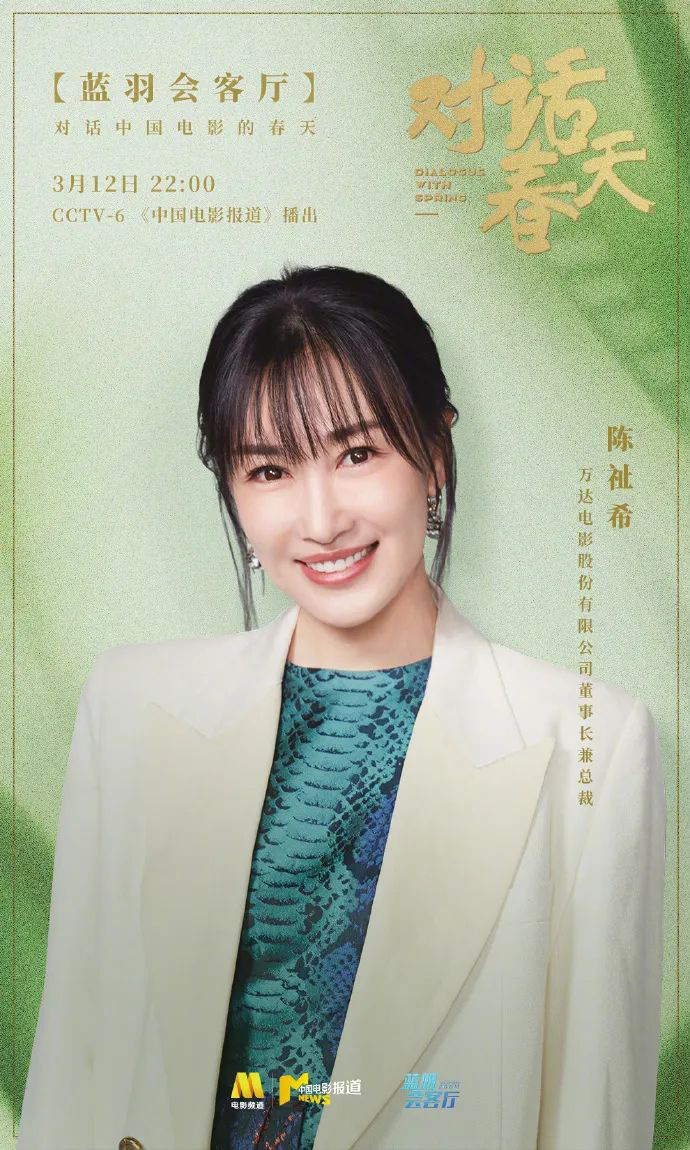

Click to watch: "Blue Feather Living Room" special program of the two sessions | "Dialogue Spring": Chen Zhixi, WANDA CINEMAS

Click to watch: "Blue Feather Living Room" special program of the two sessions | "Dialogue Spring": Chen Zhixi, WANDA CINEMAS